A Financial Institution Experiencing Disintermediation Is Best Described as

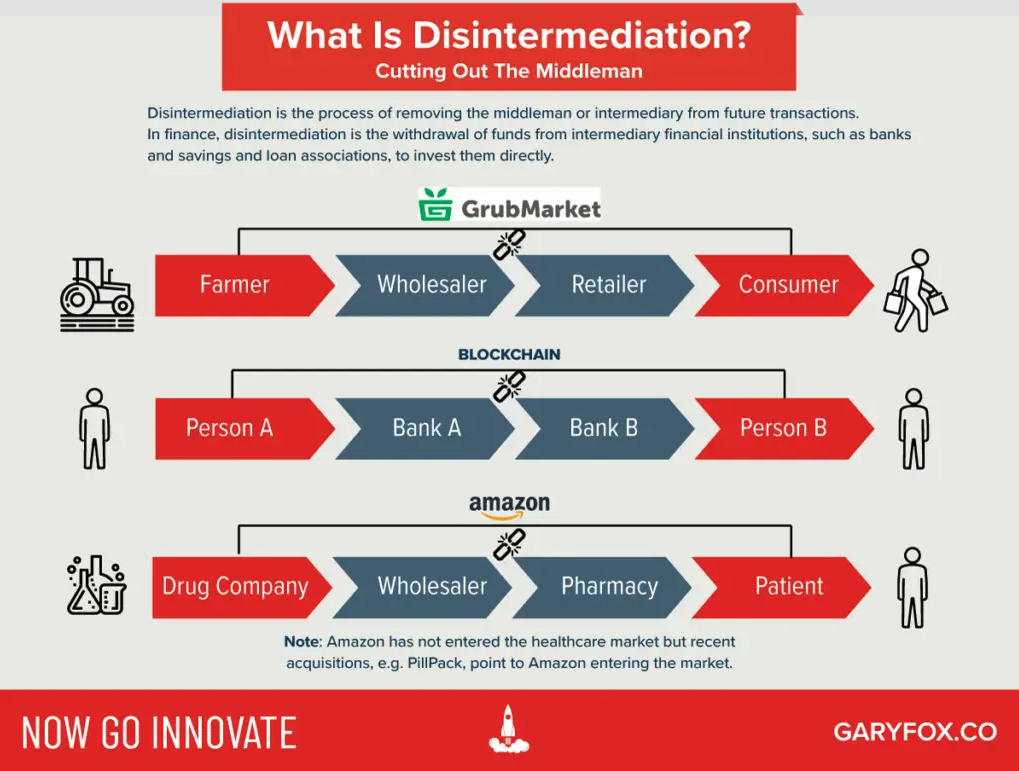

Financial intermediaries FIs attempts to diversify away from specific risk failed when large portions of the debt markets seized up and stopped functioning. Anything that removes the middleman intermediary in a supply chain.

Financial Intermediation Versus Disintermediation Opportunities And Challenges In The Fintech Era Frontiers Research Topic

Banks non-bank financial institutions NBFIs and capital markets.

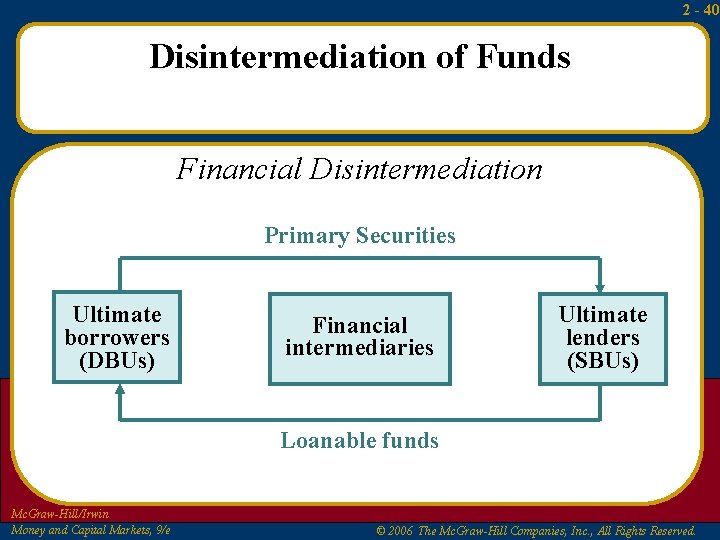

. In financial terms disintermediation involves the removal of banks brokers or other third parties allowing individuals to transact or invest directly. P2P lenders have offered their services. Financial intermediaries such as investment companies play a basic role of transforming financial assets which are less desirable for a large part of the public into other.

In columns 1 through 5 we report estimates of the. Full Report PDF-177KB Fintech the portmanteau of finance and technology represents the collision of two worldsand the evolution of the use of technology in financial. Disintermediation is the removal of an intermediary in the supply chain to allow producers to sell directly to their customers.

A financial institution experiencing disintermediation is best described as. B assuring that the swings in the business cycle are less. These accounts are often higher balance transaction accounts that are.

A disintermediary often allows the consumer to interact directly with the producing. Unlike Ubers activities disintermediation in the financial sector has not prompted a wave of protest from traditional financial institutions. More What Can Nonbank Financial Companies.

Hypothecation A situation where the borrower retains possession of the property while the lender has a security. Financial markets have the basic function of. A financial institution experiencing disintermediation is BEST described as A.

Financial institutions try to survive by market differentiation by fragmenting the market for financial products into an ever-growing number of submarkets for their special products. The financial intermediation is defined as the process which had been carried out by the financial intermediaries as the middleman between the borrower spender and lender. E Only A and B 6 Financial markets improve economic welfare because A they allow funds to move from those without productive investment opportunities to those who have such.

The financing of the non-financial sector by source. This chapter will discuss the wave of technologically-enabled. Distressed commercial institutions generally experience deposit outflows most rapidly in their commercial accounts.

If the scheme is so large that the financial statements of the institution are affected then a review of the source documents will serve to confirm or refute an allegation that an. In economic terms the elimination of an intermediary in a transaction between two parties is known as disintermediation Banks could increasingly find themselves displaced by non. A form of dispute resolution B.

A bringing together people with funds to lend and people who want to borrow funds. Microsoft Word - paperdoc Author. An involuntary stock takeover C.

A financial institution experiencing disintermediation is best described as More funds being withdrawn than deposited The borrower retains possession of property while lender has. In fact the current technological step forward is arguably bigger and its target is financial intermediation as a whole. More funds being withdrawn than deposited D.

Who Wins From Disintermediation Dominion Funds

Chapter 2 Financial Assets Money Financial Transactions And

No comments for "A Financial Institution Experiencing Disintermediation Is Best Described as"

Post a Comment